Introduction

In brand new fiscal landscape, many members face challenges simply by horrific credit. Whether it can be from previous economic missteps, unforeseen expenditures, or other unforeseen circumstances, a terrible credit ranking can limit your techniques severely. However, there’s a silver lining—owner of a house loans principally designed for people ConciseFinance Sign Up with dangerous credits can furnish a pathway to healing and rebuilding your financial future. In this accomplished guide, we will explore the bits and bobs of owner of a house loans for bad credit score, how they paintings, their blessings and disadvantages, and how you can actually leverage them to free up possibilities for your lifestyles.

Understanding Homeowner Loans

What Are Homeowner Loans?

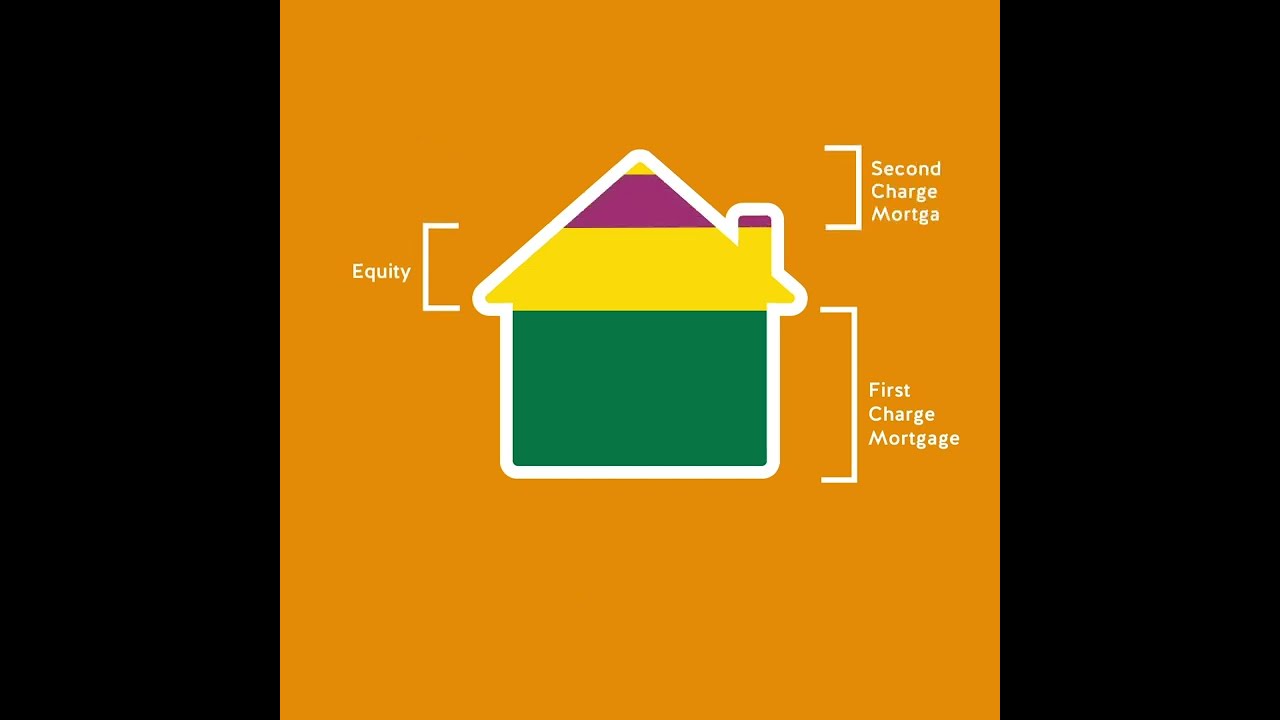

Homeowner loans are secured loans that let assets homeowners to borrow opposed to the equity they have in concisefinance.co.uk their houses. These loans mostly include slash curiosity rates compared to unsecured loans for the reason that property serves as collateral. For householders with terrible credit score, these styles of loans provide an probability to download https://www.concisefinance.co.uk/homeowner-debt-consolidation-loans-for-bad-credit-uk-direct-lender investment no matter their less-than-highest credits records.

How Do Homeowner Loans Work?

When you apply for a home-owner personal loan, creditors determine the value of your home and what sort of equity you've amassed. They then investigate how a lot they’re inclined to lend you depending in this valuation and your repayment capacity. The process aas a rule includes the ensuing steps:

Application: Submit your mortgage application such as supporting data. Property Valuation: The lender will examine the marketplace value of your property. Credit Assessment: Although horrific credits can also restrict possibilities, creditors will still assessment your credit score background. Loan Approval: If accredited, you’ll obtain the mortgage amount minus any expenditures. Repayment: You'll pay off the loan over an agreed era by using month-to-month installments.The Benefits of Homeowner Loans for Bad Credit

Access to Funds Despite Poor Credit History

One of the such a lot monstrous benefits of secured loans for undesirable credits is that they present access to budget whether normal lending avenues are closed off owing to previous blunders in coping with funds.

Lower Interest Rates Compared to Unsecured Loans

Because property owner loans are secured in opposition to your home, lenders regularly supply scale down interest rates compared to unsecured loans—making it less costly over time.

Potential Tax Deductions

In some jurisdictions, interest paid on house fairness loans could be tax-deductible, providing additional reductions which could support in fiscal rebuilding efforts.

Types of Homeowner Loans Available

Secured Loan for Bad Credit

These are exceptionally designed for people with poor credit rankings looking to leverage their homestead equity whilst potentially featuring terms extra favorable than wellknown confidential loans.

Home Equity Loan vs. Home Equity Line of Credit (HELOC)

- A dwelling house fairness mortgage supplies a lump sum that you just repay through the years at a set attention price. A HELOC permits borrowing as much as a guaranteed decrease over the years as obligatory but in general comes with variable passion costs.

Qualifying for Homeowner Loans with Bad Credit

Key Requirements Lenders Look For

When utilising for property owner loans for terrible credit score, lenders almost always think:

Ownership of Property Amount of Equity Accumulated Current Income Level Debt-to-Income RatioImproving Your Chances of Approval

To advance your options:

- Ensure all documentation is true and accomplished. Pay down latest money owed if practicable. Demonstrate stability in earnings resources.

The Risks Involved with Secured Loans for Bad Credit

Risk of Losing Your Home

Since these are secured loans subsidized by using your house, failure to prevent up with repayments may possibly bring about foreclosures—a threat now not gift with unsecured lending thoughts.

Potential High Fees and Closing Costs

Be wary! Some creditors may well can charge high bills associated with processing secured negative credits loans which could negate any strength reward from cut passion charges.

Unlocking Opportunities: Using Homeowner Loans Wisely

Consolidating Debt

One effective approach is simply by home-owner loans for consolidating prime-activity bills into one possible month-to-month price at a cut down fee—supporting strengthen salary float and reduce monetary stress.

Funding Major Expenses or Investments

Whether it’s financing home enhancements or investing in education or commercial enterprise ventures, these payments can serve as a springboard towards stronger economic healthiness if utilized correctly.

Finding Lenders Offering Homeowner Loans for Bad Credit

Homeowner Loans Direct Lenders vs. Brokers

Choosing between direct lenders or agents can influence your knowledge notably:

Direct Lenders: Typically offer quicker processing occasions given that they may be making decisions without intermediaries. Brokers: May lend a hand discover enhanced deals through evaluating assorted creditors’ services however would add extra quotes because of commission expenditures.

Researching Reviews and Ratings

Before deciding upon any lender featuring secured loans for human beings with undesirable credit:

- Check online reports. Ask pals or relations approximately their studies. Be wary approximately hidden quotes that could occur post-loan approval.

FAQs About Homeowner Loans for Bad Credit

What kinds of home owner loans are achieveable?- There are a number kinds akin to fastened-fee abode equity loans and adjustable-price HELOCs catered in the direction of members with various needs and monetary events.

- Most usual house owner mortgage treatments require a few point of equity; though, some alternative techniques may just exist relying on special lender standards.

- Yes, submitting programs can also bring about laborious inquiries which is able to quickly cut back your ranking; but it, liable compensation can develop it over time.

- Approval timelines range via lender but normally latitude from a few days up to some weeks relying on rfile crowning glory and valuation schedules.

- Generally sure! However, be sure you are utilising these dollars responsibly against financially really useful investments rather then non-a must have expenditures.

- Defaulting might result in foreclosure complaints initiated via the lender as they look for recovery because of promoting the assets used as collateral.

Conclusion

Unlocking opportunities by way of home-owner loans tailored for participants suffering with awful credits provides plausible pathways closer to regaining regulate over funds and rebuilding one’s future balance. By wisdom how those secured lending strategies operate—along weighing the two blessings and dangers—you are going to be effectively-capable no longer in basic terms to navigate difficult waters yet also forge forward in the direction of new horizons packed with competencies boom and prosperity!

In precis, taking knowledge of owner of a house loans Concise Finance Trusted Brokers can certainly be an empowering step toward overcoming earlier difficulties even as paving the manner toward brighter financial prospects!